Employer Fica And Medicare Rates 2025 Lok - What Are Fica And Medicare Deductions, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. In 2025, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2023. Employers must match this tax as well. Budget 2025 expectations live updates:

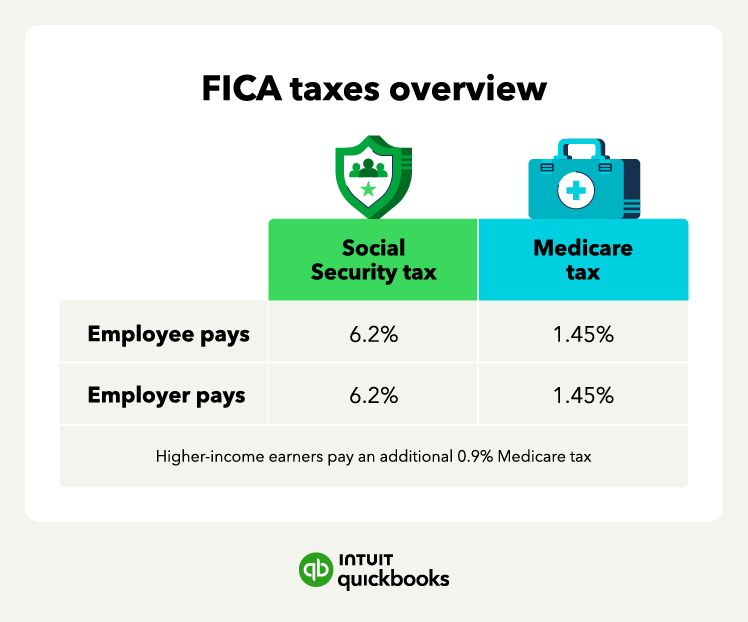

What Are Fica And Medicare Deductions, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. In 2025, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2023.

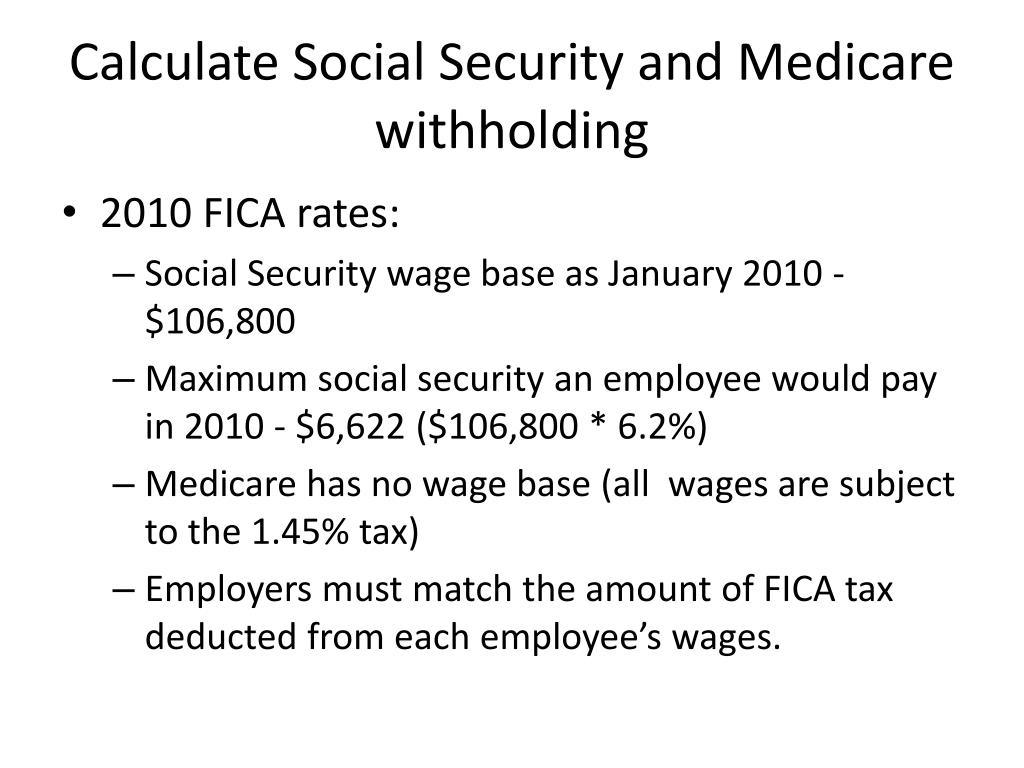

How Much Is Fica 2025 Abbey, Fica stands for the federal insurance contributions act, and it’s. To calculate fica (federal insurance contributions act) taxes in the united states, which include social security and medicare taxes, follow these steps:

Fica And Medicare Tax Rates 2025 Adara, For both of them, the current social security and medicare tax rates are 6.2% and 1.45%, respectively. As you can see, the employer’s portion for the social.

What Is The Medicare Tax Limit For 2025 Grete Verile, For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). For both of them, the current social security and medicare tax rates are 6.2% and 1.45%, respectively.

Fica And Medicare Tax Rates 2025 Adara, For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). Stay informed on employer updates, individual shifts, and federal regulations.

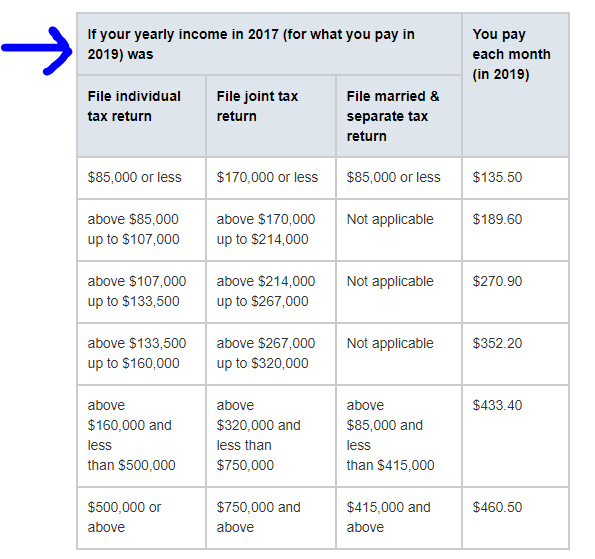

Employer Fica And Medicare Rates 2025 Lok. 1.45 percent medicare tax (the “regular” medicare tax). Medicare tax rate for 2025:

If you work for an employer, you are responsible for half of the total bill (7.65%), which includes a 6.2% social security tax and 1.45% medicare tax on your earnings.

For both of them, the current social security and medicare tax rates are 6.2% and 1.45%, respectively.

What Are The Current Fica And Medicare Rates, Fica taxes owed by the employer: Under fica, you also need to withhold 1.45% of each employee’s taxable wages for medicare.

Medicare Agi Limits 2025 Berti Konstance, What is the employer fica rate for 2025? In 2025, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2023.

Cost Of Medicare Part C In 2025 Avrit Carlene, Both employees and employers contribute to fica tax, with a combined rate of 15.3%. Employers must match this tax as well.